Black Friday ROI: Why You Need to Look Beyond the 24-Hour Revenue Spike

- Published

- 15 min reading

The confetti has settled. The server load graphs have finally returned to a normal heartbeat. And you’re probably staring at a Q4 revenue spike that is going to look fantastic on the next board deck.

But how much of that was real growth, and how much was just a discount-fueled sugar rush? How many of those buyers are loyal to the deal and not your brand? And how can you ensure they come back?

If you stop measuring success at midnight on Black Friday, you’re missing the point. The true ROI of this season is hidden in the critical 90-day window that follows.

So, put down the vanity metrics for a moment. It's time to find out which of those new buyers are just tourists, and which ones we can convince to move in.

The Data Reality: Distinguishing Tourists from Residents

In the boardroom, the CFO loves a good Gross Merchandise Value chart. But as a loyalty leader, you know that GMV is a "loud" metric. It shouts about volume but whispers about value.

To understand the real impact of Black Friday, you need to filter out the noise. Identify the Residents (the customers who show early signs of sticking around) and separate them from the Tourists who are just passing through for the cheap souvenir.

Switch your focus to Loyalty Signal KPIs. These are the indicators that tell us if a relationship is forming beneath the transaction.

1. Second Purchase Velocity

This is the single most critical metric in Q1. How many days does it take for a Black Friday acquirer to return without a massive discount?

- The Tourist: Returns only when you send a "Final Clearance" email.

- The Resident: Returns within 30-45 days to buy an accessory, a refill, or a complementary product at full (or near-full) price.

2. The "Burn" Rate (Redemption)

This is counter-intuitive, but crucial: You want your new customers to burn points immediately.

If a customer joins your program on Black Friday and redeems a small reward within 30 days, their likelihood of churning drops precipitously. Redemption is a habit-forming action. It proves they understand the value of the program, not just the value of the product.

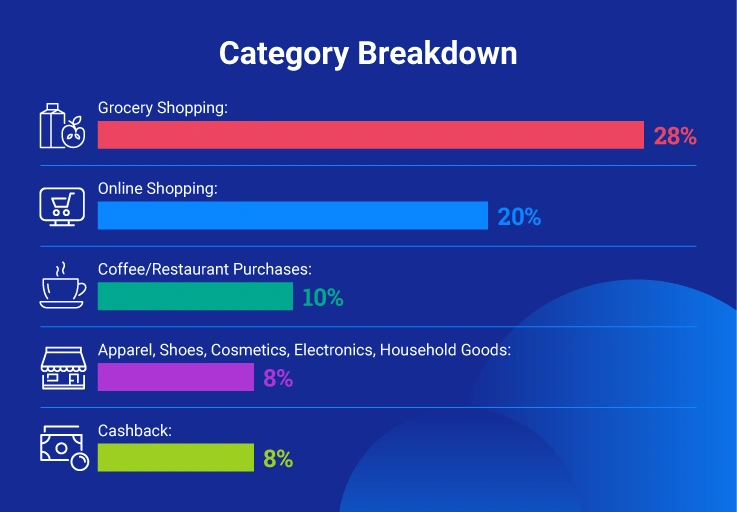

According to our 2025 Loyalty Predictions Report, consumers prefer to redeem loyalty points mostly on everyday essentials.

Grocery shopping is the most popular category (28%), followed by online shopping (20%). Dining-related rewards such as coffee or restaurant purchases make up 10%. Another 8% of consumers choose to redeem points on retail products like apparel, shoes, cosmetics, electronics, or household goods, and another 8% opt for cashback.

3. Non-Transactional Engagement

Did they download the app? Did they complete a profile preference center? Did they refer a friend?

Our research shows that 23% of Millennial and 18% of Gen Z consumers join loyalty programs because of friends or family recommendations.

These are high-intent behaviors that often go unmeasured because they don't have a dollar sign attached immediately. But in the long run, a customer who downloads your app is worth 3x more than one who just bought a discounted TV as a guest user.

If your dashboard only shows revenue, you’re flying blind. You need a Single Source of Truth that unifies transactional data with behavioral signals to see the full picture.

The 90-Day Window: The Make-or-Break Cycle

Why 90 days?

Behavioral psychology (and Scientific American) tells us it takes about 66 days to form a new habit. In the world of loyalty, we round that up to a fiscal quarter. The 90-Day Post-Purchase Window is the "Valley of Death" for Black Friday cohorts.

If a customer hasn’t engaged with you by the end of February, the statistical probability of them ever buying again drops to near zero. They are effectively churned.

Rethinking ROI through the Lens of LTV

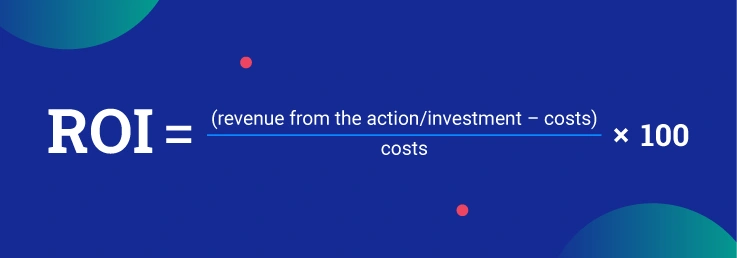

Many organizations calculate Black Friday ROI simply:

Source: eBook "The ROI of a Loyalty Program"

That’s short-term thinking. To truly prove the value of your loyalty program to the C-Suite, you need to calculate Predicted LTV.

Imagine two cohorts:

- Cohort A (Organic): Acquired in October. Cost per Acquisition: $20. Day 90 Retention: 30%.

- Cohort B (Black Friday): Acquired in November. Cost per Acquisition: $10. Day 90 Retention: 5%.

On paper, Cohort B looks cheaper. But due to high churn, their LTV is abysmal. Your job is to use AI and Machine Learning to spot the 5% in Cohort B who behave like Cohort A, and invest your marketing budget exclusively in them.

Using predictive modeling, you can tell your CFO: "We acquired 50,000 high-value customers who will generate $50M over the next 12 months."

That is how you change the conversation from "Cost Center" to "Revenue Generator."

Strategy: Operationalizing the Loyalty Journey

Okay, we have the data. We know the timeline. Now, what do we actually do?

You can’t treat a Black Friday customer the same way you treat a loyalist of five years. You need a dedicated 90-Day Retention Roadmap. Here is a proven framework to operationalize that journey.

Phase 1: The Detox (Days 1-30)

- The Goal: Break the addiction to discounts.

- The Tactic: Stop sending "% Off" coupons. Start sending "Value Add" offers.

- In Action: instead of "Come back for 20% off," try "You earned 500 points on Black Friday! That’s enough for a free coffee/accessory/upgrade."

This triggers the "Endowment Effect"—people value what they already own (points) more than what they might gain (a discount).

Phase 2: The Connection (Days 31-60)

- The Goal: Build Emotional Loyalty.

- The Tactic: Make them feel smart, not just lucky.

- In Action: Use this time to educate them on the product they bought. If they bought running shoes, send a guide on "How to train for your first 5K." If they bought a flight, send a "Local’s Guide" to the destination.

This is where personalization is non-negotiable. If you send a generic newsletter here, they will unsubscribe. If you send relevant content, they will trust you.

Phase 3: The Win-Back (Days 61-90)

- The Goal: The Safety Net.

- The Tactic: Predictive Churn Prevention.

- In Action: This is where your AI/ML engine earns its keep. The system should automatically flag customers who haven't engaged in 60 days but have a high predicted LTV.

Trigger an aggressive, personalized offer now. This is the "Break Glass in Case of Emergency" moment. "We miss you" campaigns work best when they are timely, not when they are sent 6 months too late.

Future Trends: What the Data Tells Us About Next Year

1. The "Season" is Now a Quarter

Forget the idea of a single peak weekend. The data proves that the sprint has become a marathon. Adobe projects US online sales will hit a massive $253.4 billion this holiday season (Nov. 1 – Dec. 31).

While Cyber Week is still the heavy hitter, the spending is bleeding out into the rest of the calendar. We are expecting a record 10 days where consumers spend over $5 billion in a single day (up from 7 days last year).

Interestingly, while Cyber Monday remains the king of volume ($14.2B), Black Friday is the king of momentum, seeing the highest growth rate at 8.3% YoY (hitting $11.7B).

- The Loyalty Opportunity: You are no longer fighting for attention on just one Friday; you are fighting for share of wallet across a quarter. This means you have multiple chances to capture data. Don't rely solely on the Cyber Week blast.

- The Play: Use the weeks before and after the peak, when those other billions are being spent, to deploy Zero-Party Data campaigns. Ask them what they want in early November, so you can target them with laser precision when the Black Friday surge hits.

2. AI is the New Front Door (And It’s Wide Open)

If you thought AI was just a backend tool for efficiency, look at the traffic logs. On Cyber Monday 2024, traffic to retail sites coming directly from chatbots (like ChatGPT or Gemini) increased by 1,950% compared to the year prior.

We are seeing a fundamental shift in discovery. Instead of browsing endless category pages, younger generations are "outsourcing" the hunt. 15% of Gen Z and Millennials now expect to use AI to find gift ideas.

- The Loyalty Opportunity: The data suggests AI is currently the "Planner," not yet the "Payer." Consumers are using it to discover products, but they still land on your site to transact.

- The Play: Your loyalty program needs to bridge this gap. Since AI relies on context, the Zero-Party Data you hold is gold. By integrating this data into your onsite search and recommendation engines, you ensure that when the AI bot sends a user to your site, they land on a personalized experience that feels like magic, not a generic landing page.

3. The "Loyalty Recession" and the Rise of BNPL

Consumers are feeling the pinch, and their loyalty is up for auction. Many shoppers are willing to switch brands for a better price and their "brand love" is being tested by "wallet reality." This frugality is driving the explosion of Buy Now, Pay Later (BNPL), which is expected to drive over $20.2 billion in online spend in 2025 (up 11% YoY).

Look at the giants: Klarna recorded $823 million in revenue in Q2 2025 alone. Perhaps most telling of the sector's maturity, their revenue per employee has nearly tripled in two years to $1 million, signaling a highly efficient, AI-driven ecosystem that is here to stay.

Interestingly, according to Harvard Business Review, BNPL consumers spend an average of 10% more per purchase than those using traditional methods.

- The Loyalty Opportunity: Stop viewing BNPL users as "budget shoppers" and start viewing them as "high-AOV opportunities." That 10% lift is pure margin expansion.

- The Play: Integrate BNPL into your loyalty tiering. Don't just accept the payment; incentivize it. Offer "Bonus Points on BNPL" to encourage that higher basket size, then use the installment period (usually 6-8 weeks) to trigger automated loyalty communications that keep your brand top-of-mind while they pay off the purchase.

4. Trust is the New Currency

In the chaos of Black Friday, it’s easy to assume that "Lowest Price" is the only variable that matters. But the data reveals a different reality.

According to our research, quality is the number one factor consumers consider when shopping, cited by 68% of shoppers. If a customer buys on Black Friday because of the price, but stays because of the quality, you have a future advocate. If the quality misses the mark, no amount of "We Miss You" emails will bring them back.

Quality is the gateway to trust, and trust is where the margin lives. Salsify’s 2025 report confirms that 87% of shoppers will pay more for brands they trust. You don't have to be the cheapest option in the market if you are the most reliable.

Our Loyalty Predictions report shows that 92% of consumers value a good loyalty program and are significantly more likely to stay loyal to that brand, especially when they feel they can trust the brand with their personal data.

- The Loyalty Opportunity: In 2026, your loyalty program is the bridge between "Product Quality" and "Data Trust."

- The Play: Be radically transparent. If you are asking for Zero-Party Data (sizes, preferences, dates), explicitly tell the customer why ("Tell us your size so we never show you out-of-stock items again"). When customers see that their data is being used to improve the quality of their experience (and kept secure) they stop being defensive and start being collaborative.

The Long Game: Winning the 90 Days After the Hype

Black Friday is a powerful injection of liquidity, but it is a poor substitute for a long-term strategy.

The brands that win in 2026 won’t be the ones with the deepest discounts. They will be the ones that can look at a sea of anonymous transactions and spot the future brand advocates swimming against the current.

You now know how to measure the 90-day value of your new customers. The next challenge is how to keep them without destroying your margins on constant coupons.

Engage your Black Friday cohort without relying on discounts. Discover how to use behavioral mechanics to build habit and emotional loyalty.

Download our eBook, “Level Up Your Loyalty Game: Why Gamification is the Missing Engine in Modern Customer Engagement,” to see how gamification can transform your retention strategy.